So are you amongst those who are participating in the India’s biggest economic revolution? While it has certainly brought about nightmares to the corrupt people, black money holders and terrorists, but, it has also boosted up the will power and hope of the unemployed, jobless, poor, middle income families and all others who are holding white money! Here are the facts that you need to know about Modi’s Demonetization Scheme of ₹ 500 and ₹ 1000 Old Series Bank Notes:

- Ending the Shadow Economy

One of the prime reasons for PM Modi to announce this overnight demonetization scheme on November 8th 2016 – was to drive away the Shadow Economy. Many of us don’t know about this fact, but in reality, this shadow economy has slowly accounted for a 1/5th of India’s $2.1 trillion GDP, which isn’t reaching to the hands of the state/ fund of India – thus, giving a major blow to the growth and progress of the Indian Economy.

- Paving ways for a Cashless Economy

Did you recently see your neighbourhood Chaiwalas and Vegetable Vendors, accepting payments via Free charge or other recharge wallets? Well, Digital Wallets, Online Payments, m-payments, or in short, being cashless – is the new fad. As a part of the revolutionary Digital India Scheme by PM Modi, this is the biggest move to push India’s spending/ saving habits into the cashless mode:

- What?- Digital Wallets helps you to make cashless transactions and online payments for almost all category of products/ services, ranging from Grocery and Household Items to paying Insurance Premiums, Bills and Fees.

- Why? – It’s easy, convenient and hassle free (at least you don’t have to worry for cash in this crisis season of #Noteban). And adding more to it, you can additionally get up to 70% discounts or cash backs from these digital wallets using offers like Paytm recharge coupons.

- How? – You can add up to ₹ 10, 000 (and extend it to ₹ 1 Lac with ID Proof) in your digital wallets like Paytm, Mobikwik, Freecharge, State Bank Buddy, ICICI Pockets or Oxigen Wallet (Apps or Website). Use the money in your digital wallet to pay across all merchants in India that are affiliated to the wallet site. You can also receive and accept payments with shops and friends.

- 3. The collections

Did you know that within just 3 days of the announcement, all banks across India were able to receive about 3 Trillion Rupees with about a record breaking 180 million transactions! Well, all of this is certainly not black money, but, this step has at least brought the un-participatory household savings back into the economy – thus, boosting up the value of rupee in the near future.

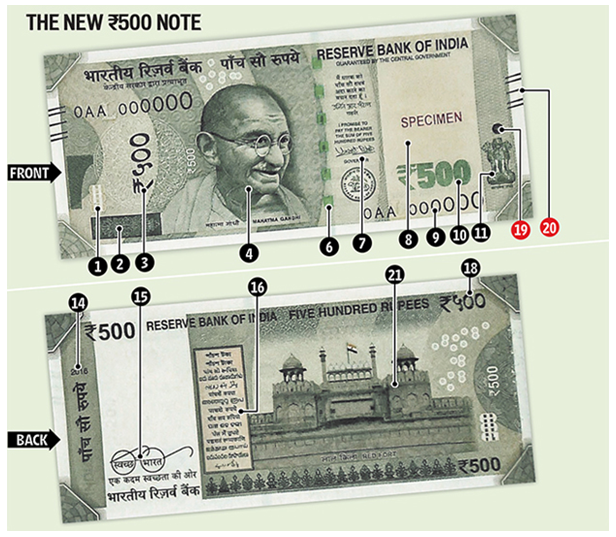

- New Security Features (anti-counterfeit)

Here are some new security features that are added to the ₹500 and ₹2000 bank notes, to stop usage of counterfeit money in circulation.

RBI, Government, Members of the Finance Ministry and the Bankers – all are well aware of the grave situation and the crisis. And all of these hardships are being done with a very positive hope of revolutionizing and giving a power boost to the India’s Economy in the near future.